Written by Mark Hengel

Three Peer Group Strategies Banks Should Know About

April 2023

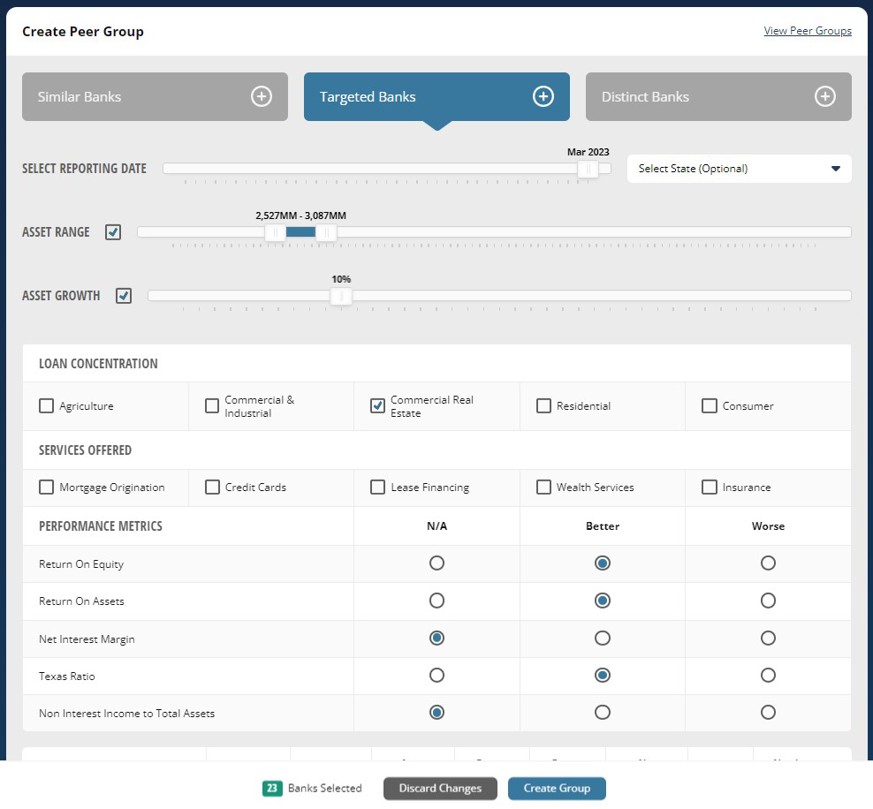

There are truly countless strategies to utilize when you have the metrics of every bank in the United States at your fingertips. However, we’ve managed to narrow down a few ideas to help you get started with your Peer Comparison journey. Here are three strategies any bank can implement as soon as they get started.

1) Emerging Competitors

Banks with forward thinking leadership create peer groups of their emerging competitors. They keep an eye on competitors who are beginning to gain market share from their client base. By creating a peer group like this, smarter banks can prepare for whatever their newest competitor may have in store. Peer Comparison allows you to create peer groups across multiple segmentations. This will allow you to identify banks who are your hidden competitors. It’s intuitive and easy to use but if you need help, our business analysts are standing by to assist you.

2) Vendor Evaluation

Have you ever wondered if working with a vendor is actually worth it, but didn’t have a way to check the results they claim? By creating a vendor evaluation group, you can do exactly that. Ask the vendor for a list of banks that they have worked with and create a peer group of those banks. You can now track all those institutions to determine how valuable the vendor has been to those banks’ business objectives. Our data timeline goes back to 2007, giving you more than enough information to come to a conclusion. Once you see the results, you can make a well informed decision on if this vendor is worth the investment.

3) Regulatory Defense

Peer groups are not only helpful for your business strategy, but they are also useful for regulatory reasons as well. Having a group of similar banks and those banks’ metrics can arm you with what you need to defend yourself against regulators. Use this group to identify metrics that a regulator may point out as something that your bank should work on. Know ahead of time what they may ask additional questions about and be prepared with a response. If a regulator questions a metric that is on track with the rest of your peers, you have a list of banks with similar metrics that you can show them. Peer Comparison does the work for you, allowing you to get back to serving your customers.